Sales vs Revenue vs Profit are three critical financial metrics that serve as the foundation for measuring a company’s performance. While often used interchangeably, these terms have distinctly different meanings and applications. Sales reflect the income generated strictly from goods or services sold. Revenue includes income from all business activities, making it a more comprehensive metric. Profit, the ultimate measure of financial health, is what remains after subtracting expenses from revenue. Understanding how these metrics work together, their unique roles, and the contexts in which they are most useful is essential for steering a business toward sustainable growth and profitability.

What is Sales, What is Revenue, and What is Profit?

When assessing the financial health of a business, it’s essential to understand the distinctions between sales, revenue, and profit. Though these terms are often used interchangeably, they represent distinct aspects of a company’s financial performance. Each serves as a key business performance indicator (KPI) that provides valuable insights into the operations, growth, and overall profitability of an organization. Here’s an in-depth look at the meaning and significance of these terms.

What is Sales?

Sales refer specifically to the total value of goods or services sold by a business over a specific period. It’s a direct measure of how much income a company generates from its primary business activities, such as selling products or delivering services. For instance, if a clothing store sells 500 items worth $50 each, its sales would amount to $25,000. Sales figures often represent the “top line” of an income statement, reflecting gross revenue before subtracting any costs, discounts, or returns. Monitoring sales performance regularly is critical for businesses to gauge consumer demand and market positioning.

What is Revenue?

Revenue is the total income a company earns from all its business activities, not just sales. In addition to sales of products or services, revenue may include ancillary sources of income such as fees, interest, rental income, royalties, or dividends. For example, a retail company may earn its primary revenue from selling merchandise but also generate additional revenue through extended warranty programs or investments. Essentially, revenue is a broader term than sales and provides a fuller picture of the company’s financial inflows. It’s a crucial metric for understanding an organization’s business volume and growth trajectory.

What is Profit?

Profit represents the financial gain a company retains after deducting all expenses from its total revenue. These expenses include operational costs, employee wages, taxes, and overheads. There are three types of profit: gross profit (revenue minus cost of goods sold), operating profit (gross profit minus operating expenses), and net profit (the “bottom line” – revenue minus all expenses). Profit is a major indicator of a business’s success and financial sustainability. While revenue shows the income generated, profit reflects how efficiently the company converts that income into financial gains. Over time, consistent profit growth is the hallmark of a strong business.

What is the Main Difference Between Sales and Revenue?

The main difference between Sales and Revenue is that sales account solely for the income generated from selling goods or services, while revenue encompasses all income streams, including both sales-related earnings and non-operational income. For instance, a car manufacturer’s sales would include the total value of the automobiles sold, whereas its revenue might also include income from financing programs, licensing agreements, or dividends. Put simply, all sales are part of revenue, but not all revenue comes from sales. By analyzing both metrics, businesses can gain deeper insights into their earning power and overall financial performance.

What is the Main Difference Between Revenue and Profit?

The main difference between Revenue and Profit is that revenue refers to the total income earned by a business from its various streams before any expenses are deducted, whereas profit is what remains after all expenses have been subtracted from the revenue. For example, if a business earns $1 million in revenue but incurs $700,000 in operating and other expenses, its profit would be $300,000. Revenue provides a snapshot of a company’s earning capability, while profit shows its ability to manage costs and generate financial gains. Profitability determines long-term business viability, while revenue reflects the scale of operations.

What is the Main Difference Between Sales and Profit?

The main difference between Sales and Profit is that sales represent the income generated strictly from the sale of goods or services, while profit is what remains after deducting all costs and expenses associated with generating that income. For example, a company might report $500,000 in sales, but if its production costs and overheads amount to $450,000, the profit would only be $50,000. Sales provide insight into a company’s market performance and customer demand, whereas profit measures financial efficiency and sustainability. Businesses need strong sales to thrive, but controlling expenses is equally crucial to achieving high profits.

Features of Sales vs Features of Revenue vs Features of Profit

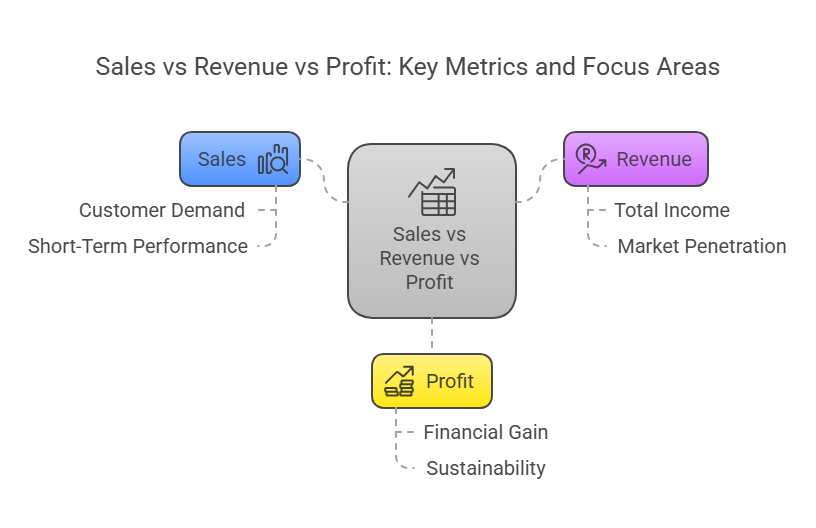

- Sales: Core Metric of Operational Success

- Sales reflect the total income generated directly from the sale of goods or services.

- It is a primary indicator of customer demand and short-term market performance.

- Sales are easy to calculate and directly linked to daily business activities.

- Revenue: Comprehensive Income Indicator

- Revenue includes income from all streams, not just sales, offering a holistic picture of overall earnings.

- It is critical for understanding a business’s scale, market penetration, and total income trends.

- Revenue is vital for comparing diversified or multi-channel businesses.

- Profit: Measure of Financial Efficiency

- Profit represents the actual financial gain after deducting all expenses, taxes, and costs from revenue.

- It is the ultimate measure of whether a company is financially viable and sustainable.

- Profit helps businesses identify inefficiencies, plan for investments, and provide shareholder returns.

- Sales: Granular Product or Region-Level Focus

- Sales enable businesses to dive deeper into the performance of specific products, services, or regions.

- It is particularly useful for identifying best-sellers or underperforming segments.

- Revenue: Both Gross and Net Income Views

- Revenue can be presented in multiple forms, such as gross revenue (before adjustments) or net revenue (after discounts and returns).

- It provides management with options to analyze income at different levels of granularity.

- Profit: Link to Strategic Goals

- Profit ties directly to business objectives like increasing shareholder wealth, improving cost efficiency, or expanding operations.

- Multiple types of profit (gross, operating, net) assist in identifying opportunities for cost reduction at different levels.

- Sales vs Revenue vs Profit: Different Focus Areas

- Sales focus on volume and transactional success.

- Revenue centers around total income generation.

- Profit emphasizes financial health and future sustainability.

- Ease of Actionability:

- Sales are actionable in real time.

- Revenue offers a broader mid-term view.

- Profit provides insights for long-term financial strategies.

Key Differences Between Sales and Revenue

- Scope of Income Streams: Sales are a subset of revenue and include income solely from the sale of goods or services, while revenue encompasses all forms of income, including non-sales-related earnings like rental income, royalties, or dividends.

- Diversity of Sources: Sales arise exclusively from a company’s core operations, whereas revenue can include additional streams such as income from investments, interest, or other one-time transactions.

- Direct Indicator of Business Activity: Sales directly reflect the volume of products or services sold, while revenue offers a broader perspective on a company’s overall earning capacity, including both operational and ancillary income.

- Term Usage in Financial Statements: In income statements, sales are often a line item under “Revenue” and considered part of operating income, whereas total revenue may combine operating and non-operating sources of income.

- Influence of Discounts and Returns: Sales figures are often adjusted for returns, discounts, and allowances, while revenue considers the final income recorded after all adjustments.

- Application Across Industries: Sales are often a more dominant metric in product-based businesses, whereas service-oriented companies or those with diversified income sources tend to focus more heavily on revenue.

- Gross vs. Net Perspective: Sales often represent gross income from selling goods and are reported before factoring in expenses, while revenue can include both gross and net perspectives depending on the financial reporting framework.

Key Similarities Between Sales and Revenue

- Role in Measuring Income: Both sales and revenue are key metrics used to understand a company’s income generation over a specific period, albeit from slightly different scopes.

- Contribution to Profit: Both metrics are essential for calculating a company’s profit, as they serve as the starting point for determining how much income remains after expenses.

- Included in Financial Reporting: Sales and revenue appear in income statements and provide stakeholders with important details regarding the company’s financial health and operations.

- Indicate Market Performance: Both sales and revenue metrics are used to assess how well a company performs in the market in terms of demand for its goods and services.

- Growth Indicators: Growth in both sales and revenue suggests improved business performance and increased demand for the company’s offerings.

- Impacted by Business Strategy: Sales and revenue can both be positively or negatively influenced by pricing strategies, marketing efforts, and changes in market conditions.

- Vital in Decision-Making: Businesses analyze both sales and revenue to make critical decisions related to investments, budgeting, and resource allocation.

Key Differences Between Revenue and Profit

- Definition of Income: Revenue is the total income generated from all sources before any expenses are deducted, while profit refers to what remains after subtracting expenses from revenue.

- Financial Statement Placement: Revenue is often placed at the top of the income statement as the “top line,” whereas profit is presented as the “bottom line” after all expenses have been accounted for.

- Expense Consideration: Revenue is calculated without considering expenses, while profit explicitly accounts for operating costs, taxes, and other deductions.

- Business Efficiency Indicator: Revenue indicates the earning capacity and scale of a business, while profit demonstrates how effectively the company can convert that income into financial gain.

- Variety of Profit Metrics: Profit can be broken down into gross, operating, and net profit, while revenue represents a singular, broader metric.

- Key Concerns for Stakeholders: Investors and creditors may prioritize profit when assessing a business’s financial sustainability, while revenue helps gauge overall market penetration and sales volume.

- Sustainability Insight: Profit offers deeper insights into long-term business sustainability by factoring in costs, whereas high revenue without sufficient profit may indicate inefficiencies.

Key Similarities Between Revenue and Profit

- Indicators of Financial Performance: Both revenue and profit are critical indicators used to assess a company’s financial health and operational success.

- Essential for Investors: Investors rely heavily on both revenue and profit figures for evaluating the viability and potential returns on investment in a company.

- Dependence on Business Activity: Both metrics depend on the level and consistency of a company’s business operations, such as production, sales, and service delivery.

- Used in Financial Ratios: Key financial ratios, such as profit margin and revenue growth rate, rely on both metrics to gauge performance metrics for decision-making.

- Impact of Market Conditions: Revenue and profit are influenced by external factors like market trends, competition, and economic conditions.

- Growth-Oriented Metrics: Both metrics are closely monitored to assess whether a business is moving toward growth and expansion over time.

- Dependence on Pricing Strategies: Pricing strategies, discounts, and product/service quality directly impact both revenue and profit levels.

Key Differences Between Sales and Profit

- Direct vs. Net Measurement: Sales represent the direct income from goods or services, while profit reflects the net amount after deducting costs like production, marketing, and operational expenses.

- Operational Control: Sales are determined by pricing, demand, and volume sold, whereas profit is heavily influenced by expense management and efficiency in operations.

- Level of Detail Provided: Sales provide a surface-level understanding of income generation, while profit offers insights into how well a business controls costs and generates financial value.

- Focus Area: Sales focus on income generation, while profit focuses on both income generation and financial performance efficiency.

- Influence on Business Scalability: High sales don’t always lead to high profit, as poor cost management or high expenses can erode profitability.

- Representation in Metrics: Sales highlight gross revenue from operations, while profit indicates success in achieving long-term financial sustainability.

- Stakeholder Interests: Sales are often of primary interest to sales teams and marketing managers, while profit is the primary focus for executives and investors.

- Timing and Trends: Sales figures may fluctuate seasonally, but profit offers a more consistent long-term picture of financial performance.

Key Similarities Between Sales and Profit

- Motivated by Business Activity: Both sales and profit depend directly on a company’s ability to generate demand for its products or services.

- Indicators of Financial Stability: Both metrics are crucial indicators of how a business is performing, though they highlight different aspects of financial health.

- Drivers of Business Planning: Sales and profit figures play a critical role in formulating strategies for growth, resource allocation, and market expansion.

- Subject to Market Dynamics: Both sales and profit are influenced by external factors such as competition, customer behavior, and overall economic conditions.

- Aligned with Business Goals: Both metrics are used to evaluate whether a company is meeting its financial and operational goals.

- Require Efficient Execution: Achieving high sales or profit depends on well-coordinated efforts across sales, marketing, production, and financial management teams.

- Linked to Revenue: Both sales and profit directly contribute to revenue figures and help pinpoint areas for improvement in business operations.

- Critical for Financial Forecasting: Sales and profit are core components in financial forecasts, helping businesses set future growth targets while ensuring sustainable operations.

Pros of Sales Over Revenue and Profit

- Immediate Reflection of Business Activity: Sales provide an instant and direct measure of a company’s success in moving products or delivering services, making it a valuable KPI for tracking short-term business performance.

- Clear Relationship with Market Demand: Since sales directly indicate how many goods or services have been sold, they offer clear insights into customer demand and market trends, which are essential for operational adjustments.

- Easily Measurable and Trackable: Sales figures are straightforward to track and analyze, enabling businesses to monitor daily, weekly, or monthly progress and make timely decisions.

- Foundation of Revenue and Profit: As a subset of revenue and a building block for profit, sales represent the fundamental starting point for understanding a company’s financial flows.

- Drives Sales Team Motivation: Tracking sales figures motivates employees, especially sales and marketing teams, as it provides tangible progress toward goals and rewards performance.

- Simplifies Sales Strategy Evaluation: Sales data helps businesses assess the success of pricing strategies, promotions, or product launches, providing actionable insights for fine-tuning operations.

- Industry-Specific Importance: In industries like retail or fast-moving consumer goods (FMCG), sales play a more significant role in assessing performance than either revenue or profit.

- Real-Time Impact: Sales can show real-time results of marketing and promotional campaigns, allowing businesses to make quick adjustments to maximize performance.

Cons of Sales Compared to Revenue and Profit

- Inability to Capture Non-Sales Income: Sales focus solely on goods or services sold and do not account for other sources of income, such as investments, royalties, or interest.

- Lack of Profitability Insight: High sales figures don’t necessarily translate into profitability, as they exclude operating costs, taxes, and other expenses that significantly impact the bottom line.

- Vulnerability to Discounts and Returns: Sales figures often appear inflated before accounting for customer returns, refunds, or discounts, which can distort the true financial picture.

- Ignores Expense Management: Unlike profit, sales do not consider the cost of operations, leaving businesses unaware of inefficiencies or overspending that could impact sustainability.

- Limited Use in Long-Term Decisions: While useful for short-term tracking, focusing solely on sales may lead businesses to overlook broader financial metrics crucial for strategic planning and growth.

- Subject to Seasonal Fluctuations: Sales can vary significantly due to seasonal trends, promotions, or temporary demand spikes, offering less stability compared to other financial metrics.

- Minimal Investor Emphasis: Investors and stakeholders often focus more on revenue and profitability since these metrics provide a comprehensive picture of the business’s financial health.

Pros of Revenue Over Sales and Profit

- Comprehensive Measurement: Revenue captures all income streams, including sales, interest income, royalties, rents, and dividends, offering a complete picture of a company’s financial inflows.

- Supports Scalable Decision-Making: By including non-operating income, revenue provides a broader foundation for making decisions about investment opportunities and long-term strategic goals.

- Better Benchmark for Growth: Revenue growth is a critical metric used to gauge a company’s ability to expand its operations and increase its market share over time.

- Relevance Across Industries: Unlike sales, revenue is a universally important measure, regardless of business model or industry, as it encompasses both operational and ancillary income sources.

- Valuable to Stakeholders: Revenue serves as a primary focus for investors and creditors, as it offers insights into a company’s size, market positioning, and earning capability.

- Provides Insights for Diversified Businesses: Businesses with multiple sources of income, such as licensing agreements or subscriptions, benefit from using revenue as a comprehensive metric over sales.

- Key Metric for Forecasting: Revenue trends provide valuable data for financial forecasting and setting growth targets, ensuring better preparation for future challenges and opportunities.

- Less Impacted by Seasonality: Revenue is often less volatile than sales since it includes income from non-seasonal activities, providing a more consistent financial picture.

Cons of Revenue Compared to Sales and Profit

- Overly Broad Scope: Revenue combines all income streams, making it less specific than sales and more challenging to use in understanding the effectiveness of core business activities.

- Lacks Expense Insights: Revenue is calculated before any expenses are deducted, so it doesn’t give an accurate picture of a company’s efficiency or cost management strategies.

- Doesn’t Reflect Profit Margins: Unlike profit, revenue does not indicate how much of the company’s earnings are converted into net income, limiting its usefulness in gauging financial sustainability.

- Can Be Misleading Without Context: High revenue figures may create a false sense of success if costs are disproportionately high, leading to poor bottom-line performance.

- Difficult to Compare Across Businesses: Companies with different revenue models or non-operating income streams may find it difficult to compare their performance based solely on revenue.

- Focus Shift Away from Core Operations: By including non-operational income, revenue may shift focus from the core business profitability and operational effectiveness.

- Less Actionable for Day-to-Day Decision-Making: Revenue figures are better suited for long-term analysis and are not as effective for real-time adjustments compared to sales.

Pros of Profit Over Sales and Revenue

- Ultimate Indicator of Financial Health: Profit provides the clearest picture of a business’s success in managing income and expenses, making it the ultimate measure of financial performance.

- Reflects Cost Efficiency: Profit highlights how well a business controls operating costs, providing insights into the effectiveness of expense management strategies.

- Directly Aligned with Shareholder Interests: Profit, especially net profit, is often the most critical metric for stakeholders and investors, as it directly impacts returns.

- Guides Long-Term Strategy: Profit data allows businesses to assess their financial viability and make long-term decisions related to expansion, resource allocation, and reinvestment.

- Multiple Levels of Insight: Breakdowns in gross, operating, and net profit offer detailed insights into different business segments, enabling a more granular analysis of operations.

- Focuses on Sustainability: Unlike sales and revenue, profit takes into account both current income and expenses, ensuring a more accurate understanding of a company’s sustainability.

- Enables Effective Tax Planning: Since profit accounts for deductions and expenses, it serves as a basis for optimizing tax strategies and improving tax efficiency.

Cons of Profit Compared to Sales and Revenue

- Dependent on Revenue and Sales Accuracy: Profit is heavily reliant on the accuracy of revenue and sales figures, making it subject to potential errors from reporting or adjustments.

- Complex to Calculate: Profit calculations require consideration of multiple factors, including fixed and variable expenses, taxes, interest, and depreciation, making it harder to compute and track in real time.

- Limited Value for Immediate Actions: As a metric derived after expenses, profit is less actionable for short-term operational adjustments compared to sales or revenue.

- Can Be Impacted by Accounting Decisions: Profit figures are influenced by accounting practices such as depreciation methods and expense allocation, potentially leading to inconsistencies in reporting.

- Less Relevant for High-Growth Businesses: High-growth startups may focus more on revenue than profit in the early stages, as profitability is often secondary to expanding market share.

- Doesn’t Indicate Demand Directly: Unlike sales, profit doesn’t show direct customer demand or market performance, which are vital for determining competitiveness.

- Highly Sensitive to External Factors: External factors such as tax policies and interest rate changes can significantly impact profit figures, reducing its comparability over time.

Pros of Profit Over Sales and Revenue

- Holistic Measure of Financial Success: Profit provides the most comprehensive insight into a company’s financial health by considering both income and all associated costs, ensuring a deeper understanding of operational efficiency.

- Indicator of Long-Term Viability: Unlike sales and revenue, profit reveals whether a business is financially sustainable in the long run, as it accounts for all expenses, taxes, and costs of doing business.

- Prioritized by Investors and Stakeholders: Profit—especially net profit—is often the key metric that investors and creditors analyze to assess a company’s financial stability, growth potential, and ability to provide returns.

- Reflects Cost Management Efficiency: Profit highlights whether a company is successfully managing its operational and overhead expenses, providing actionable insights to improve bottom-line performance.

- Supports Strategic Planning: Profitability trends enable businesses to allocate resources effectively, reinvest in growth opportunities, and make better decisions about product lines, pricing strategies, and market expansion.

- Guides Dividend Distribution: Net profit specifically determines the company’s ability to distribute dividends to shareholders, making it crucial for maintaining investor confidence.

- Offers Multiple Levels of Analysis: With gross, operating, and net profit metrics, businesses can analyze profitability across various stages of operations, helping identify specific areas that need improvement.

- Basis for Profit Margins: Profit serves as the foundation for calculating profit margins, which help companies benchmark their efficiency against competitors and industry standards.

Cons of Profit Compared to Sales and Revenue

- Complex to Calculate and Interpret: Unlike sales and revenue, profit requires detailed calculations that factor in taxes, depreciation, and numerous operational costs, making it harder to compute and understand for some stakeholders.

- Variable Due to Accounting Practices: Profit can be influenced by accounting methods, such as inventory valuation and amortization policies, which can create inconsistencies and hinder clear comparisons between businesses.

- Less Actionable for Immediate Decision-Making: Profit is a summary metric calculated after all adjustments, making it less suitable for real-time analysis compared to sales or revenue.

- Subject to External Volatility: Profit can be significantly affected by external factors such as tax rate changes, interest expenses, or inflationary pressures, which may not reflect a business’s core operational performance.

- Limited Visibility on Market Demand: Unlike sales, profit doesn’t provide direct insights into customer demand or the company’s competitiveness in the marketplace.

- Requires Revenue and Sales Reliability: Profit is dependent on accurate sales and revenue data. Any inconsistencies or errors in these foundational metrics can distort the profit figures.

- Less Relevant for High-Growth Startups: For startups or businesses in growth phases, profit may not be as critical as sales or revenue, as they focus on scaling and market share rather than immediate profitability.

- Short-Term Profitability Can Be Misleading: A company might show short-term profitability by cutting essential costs like R&D or marketing, which could harm long-term growth and sustainability.

Situations When Sales is Better Than Revenue and Profit

- Tracking Operational Performance: Sales are ideal for measuring the effectiveness of operational strategies like pricing, promotions, and customer outreach efforts since they reflect the direct outcome of transactions.

- Analyzing Customer Demand: Focusing on sales helps gauge customer demand for specific products or services, making it easier to identify what’s driving interest in the market.

- Short-Term Performance Monitoring: During promotional campaigns or peak seasons, sales offer a more immediate and actionable measure of success as compared to revenue or profit.

- Setting Sales Team Targets: When motivating sales teams, emphasizing sales numbers is more effective than revenue or profit since these figures are directly tied to individual and team efforts.

- Launching New Products or Services: Tracking sales is critical during a product or service launch to verify customer adoption and market penetration without the need to consider additional revenue streams or profits.

- Measuring Volume-Based Success: For businesses operating on tight margins, such as wholesalers or retailers, tracking sales volume is often more significant than monitoring revenue or profit.

- Assessing Regional or Product-Level Success: Sales data is essential for comparing the performance of individual products, services, or geographic regions to tailor strategies accordingly.

Situations When Revenue is Better Than Sales and Profit

- Evaluating Overall Business Growth: Revenue provides a comprehensive look into all income streams, making it the best indicator of a company’s overall financial growth and health.

- Monitoring Diversified Income Streams: Businesses with multiple income sources, such as rental income, royalties, or licensing fees, benefit from tracking revenue as it goes beyond sales alone.

- Benchmarking Against Competitors: Revenue is often used in industry benchmarking because it offers a total perspective on the business’s earning capacity, making it easier to compare to competitors.

- Highlighting Non-Core Earnings: In situations where ancillary income significantly contributes to total earnings, focusing on revenue offers a broader understanding than sales or profit.

- Securing Investments or Loans: Investors and lenders often evaluate revenue to assess the scale and potential of a business, making it a better metric for attracting external funding.

- Assessing Market Trends: Revenue trends offer insights into long-term market conditions and income seasonality, unlike sales, which may only capture short-term spikes.

- Analyzing Business Diversification: For companies expanding into new markets or service offerings, revenue provides a unified metric to capture the impact of these endeavors cohesively.

Situations When Profit is Better Than Sales and Revenue

- Measuring Financial Sustainability: Profit is a critical metric when assessing whether the company is operating efficiently and sustainably in the long term, as it excludes all costs and expenses.

- Evaluating Business Efficiency: When operational and cost management are prioritized, profit is the clear indicator of how effectively a business converts revenue into financial gains.

- Guiding Shareholder Decisions: Shareholders rely on profit to understand the company’s return on investment and dividend-distributing capability.

- Making Strategic Cost Decisions: Profit analysis provides insights into whether cost-cutting or process improvements are needed to increase efficiency.

- Planning for Expansion: High profitability creates a cushion for reinvestment into new projects, acquisitions, or market expansions, making it a more relevant metric for such decisions.

- Calculating Profit Margins: Businesses use profit as the foundation for key performance ratios like gross and net profit margins, which are integral to strategic evaluation.

- Evaluating Periodic Business Success: For assessing the overall success of an accounting period, profit offers the clearest picture of financial outcomes after costs and obligations are met.

Sales, Revenue, and Profit in the Context of Financial Planning

Financial planning relies heavily on understanding key metrics like sales, revenue, and profit. Knowing their role individually sharpens decision-making clarity.

How Sales Influence Forecasting and Day-to-Day Operations

Sales numbers directly show consumer demand and product-market fit. For example, if a store rapidly sells one product, it signals customer preference, prompting restocking or expansion of that product line. Small businesses often use it for short-term planning, helping them understand trends like time-bound spikes or seasonal demands.

Additionally, sales performance drives shorter operations. Daily results gathered from sales trackers or tools help managers make quick decisions on inventory or staffing. Without tracking these figures, businesses risk overestimating or underestimating market requirements, leading to potential losses.

Revenue’s Role Beyond Basic Transactions

Revenue adds an extra layer of perspective for businesses, especially those with multiple income channels. It highlights cash inflows from sources like licensing fees, partnerships, or investments, alongside core sales. This broad scope attracts investors by showcasing total business capability.

By analyzing revenue over time, businesses also gauge overall growth. For companies selling on subscriptions, examining recurring revenue ensures stability since they observe a consistent stream unrelated to daily product sales. Subscriptions improve revenue consistency by securing advanced payments over measurable periods.

Where Profit Drives Investments and Long-Term Plans

Profit most directly impacts scalability. With stable profits, businesses reinforce capital that aids expansions into new goods, services, or territories. Investors treat long-term profitability metrics like net margin as confidence signals when assessing funding opportunities.

Furthermore, profits reflect operational efficiency. If profits drop despite steady sales or revenue, leaders investigate areas eroding financial resources, such as increasing manufacturing costs or unforeseen overhead charges. Decoding profits provides decision-makers rich insights crucial during restructuring.

When and Why Metrics Matter Across Business Cycles

The relevance of sales, revenue, or profit depends largely on a business’s maturity. Each holds distinct importance during specific phases of growth.

Startups Lean Heavily on Sales for Market Fit

Early-stage startups generally track sales as their initial focus. Launching products into uncertain markets challenges startups to quickly determine what resonates with users. By noticing patterns in sales, companies identify strong-performing areas to double down upon.

Emphasizing sales also attracts early backers. Investors for growing ventures frequently use sales metrics as snapshots to judge whether the startup achieves meaningful consumer bases. Without solid early traction demonstrated through direct sales results, winning trust can become difficult.

Revenue Helps Stabilize Growth-Stage Companies

Mid-stage businesses stabilize revenue streams by targeting certain balance sheets. Recapturing returning customers boosts lifetime revenue, while optimized campaigns continue steady growth in cash inflows. At this scale, businesses smooth development factors while sustaining public attention.

Revenue trends inform partnership discussions during collaborations. Firms highlight increasing total revenues when seeking alliances. Partnerships allow growth-stage ventures focused outreach in industries they independently couldn’t penetrate faster.

Why Mature Firms Prioritize Profit Preservation

By maturity stage, businesses pivot toward ensuring profits match internal scaling needs. Established firms rely more consistently around stronger profitability benchmarks rather ensuring repeatedly shortages/errors occur valuations oversee. Strategic corrections further address legacy industry deviations maintaining profits.

FAQs

What role does each metric play in setting business goals?

Sales help set short-term tactical goals like boosting product volume or introducing discounts, revenue supports medium-term objectives like increasing total earnings across channels, and profit aligns with long-term strategic goals like sustainable growth, cost control, and maximizing shareholder value.

How are sales, revenue, and profit impacted during an economic downturn?

In an economic downturn, sales typically drop due to reduced consumer spending, which in turn affects revenue. Profit, however, is not only influenced by declining revenue but also by fixed costs that remain unchanged, often leading companies to focus on expense management to stay operationally efficient.

Can high sales lead to business failure?

Yes, high sales alone cannot guarantee business success if operational expenses exceed revenue. For instance, companies offering products at aggressive discounts may see good sales but fail to generate meaningful profit, leading to cash flow issues and potential failure.

Why might startups prioritize revenue over profit?

Startups often prioritize revenue to showcase growth and market potential during the initial phases. In such cases, short-term profitability may be overlooked intentionally to focus on acquiring customers, scaling operations, and attracting investors.

How can businesses balance focus across sales, revenue, and profit effectively?

Businesses need to align efforts across all three metrics. This involves setting sales targets to grow market share, optimizing revenue streams through diversification, and managing expenses to ensure profits. Regularly reviewing and balancing these metrics ensures comprehensive performance tracking.

What makes revenue a critical focus for businesses with variable income streams?

For businesses generating income from various sources such as subscriptions, licensing, or interest earnings, revenue offers a holistic perspective. It integrates these streams into a single metric for better financial tracking, which wouldn’t be fully captured by focusing only on sales or profit.

Are certain industries more reliant on specific metrics?

Yes, industries like retail typically emphasize sales volume, service-based sectors and software companies prioritize revenue due to subscription or licensing models, and manufacturing or energy sectors often rely on profit margins to evaluate cost and efficiency.

When should businesses rely specifically on profit for decision-making?

Profit becomes the critical metric during periods of financial pressure, decision-making about reinvestment opportunities, or when considering mergers and acquisitions. It ensures informed decisions by reflecting actual financial health after accounting for expenses.

What are some examples of non-operational factors that can influence profit?

Non-operational factors like tax rate changes, interest expense adjustments, or foreign exchange fluctuations can significantly impact profit. These factors are external to core operations but play a role in financial results and must be accounted for in strategic planning.

How do seasonal businesses strategize around these metrics?

Seasonal businesses often track sales closely during peak periods to gauge immediate market performance. They emphasize annual revenue to smooth out seasonal fluctuations and rely on profit margins to measure how well costs are managed during slow periods.

Sales vs Revenue vs Profit Summary

Analyzing sales, revenue, and profit provides a holistic view of a company’s financial performance. Sales offer insights into market demand and operational results. Revenue goes beyond sales, capturing all income streams and presenting a broader financial picture. Profit showcases cost management and long-term sustainability, revealing the success of converting revenue into financial gains. Each metric serves a unique purpose, and combining their insights can appropriately guide decision-making, resource allocation, and strategy formation. For businesses aiming to thrive, understanding and balancing these metrics is fundamental.

Comparison Table: Sales vs Revenue vs Profit

| Aspect | Sales | Revenue | Profit |

|---|---|---|---|

| Differences | Reflects income directly from goods or services sold. | Encompasses total income from all sources including non-sales. | Represents earnings after deducting all expenses from revenue. |

| Focuses on measuring demand and operational volume. | Broader metric capturing both operational and non-operational income. | Highlights cost management efficiency and long-term viability. | |

| Often used for short-term tracking and team evaluation. | Useful for assessing business scale, growth, and diversification. | Emphasizes financial sustainability and resource reinvestment. | |

| Similarities | Both track financial performance and income generation. | Both contribute to understanding a company’s financial state. | Both indicate a business’s success, though at different depths. |

| Key drivers for assessing performance and planning strategies. | Depend on pricing, market conditions, and operational success. | Provide insights into operational and strategic efficiency. | |

| Features | Simple and best for granular analysis like product or region. | Offers a more comprehensive view, blending all income sources. | Reflects net gain after all costs; divided into gross, operating, and net levels. |

| Captures immediate performance from core transactions. | Tracks overall earning capacity for both short- and long-term understanding. | Measures financial health, sustainability, and ROI. | |

| Commonly used for setting sales targets and promotions. | Includes non-operational income like royalties or investments. | Focused on evaluating true profitability post-expenses. | |

| Pros | Tracks short-term demand trends effectively. | Provides a full view of a company’s income sources. | Indicates business efficiency and sustainability for strategic decisions. |

| Motivates sales teams and adjusts real-time strategies. | Useful for diversified businesses or complex revenue streams. | Generates actionable insights for long-term growth and cost management. | |

| Easy to calculate and align with team-specific goals. | Critical for presenting earning trends to stakeholders. | Highlights financial efficiency and shareholder ROI potential. | |

| Cons | Doesn’t account for costs and profitability. | Lacks clarity on whether income is sustainable after expenses. | Complex calculation due to its dependence on multiple cost variables. |

| Susceptible to seasonal spikes and discounts. | Can overemphasize non-core income streams. | Sensitive to external factors like taxes or interest changes. | |

| Less relevant for comparing across industries with varied pricing. | Fails to showcase expense management or operational inefficiency. | Less immediate than sales for action-oriented decision-making. | |

| Situations | Best for analyzing customer demand or product launches. | Ideal for benchmarking and long-term growth evaluation. | Preferred when focusing on efficiency, sustainability, and cost control. |

| Useful for motivating sales teams with immediate performance indicators. | Suitable for measuring diversified income sources like royalties or investments. | Necessary when guiding shareholder and strategic expansion decisions. |