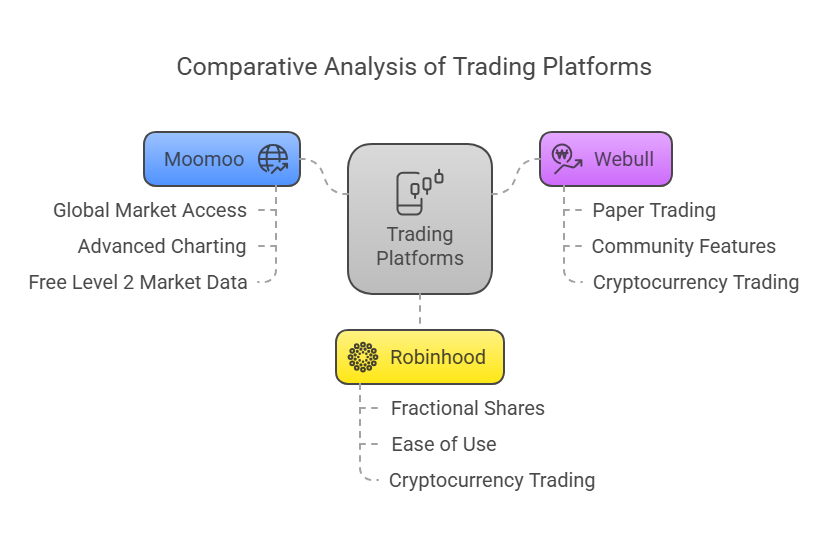

When it comes to selecting the right stock trading platform, understanding the differences between popular options like Moomoo, Webull, and Robinhood is crucial for making informed decisions. Each platform has unique features, tools, and trading functionalities tailored to different investor needs. In this artcle, we’ll dive deeper into each platform, what makes them stand out, and compare their strengths and weeknesses.

What is Moomoo?

Moomoo is a cutting-edge online trading platform designed for active investors who seek in-depth market analysis and advanced trading tools. Launched by Futu Holdings, Moomoo offers commission-free investing and caters to both beginners and experienced traders. What sets Moomoo apart is its robust research tools, including Level 2 market data, smart trading analytics, and a wide array of charting options that help traders make data-driven decisions. Additionally, Moomoo supports trading across a global range of securities, including U.S. and Hong Kong markets, which makes it a versatile platform for international investors. The platform’s sleek mobile and desktop interfaces further enhance the trading experience.

What is Webull?

Webull is a popular online brokerage platform offering commission-free trading of stocks, ETFs, options, and cryptocurrencies. It is especially well-regarded for its technical analysis tools and user-friendly design. Webull caters to tech-savvy investors, providing access to customizable charting tools, technical indicators, and extended-hours trading. In addition, Webull offers paper trading (a simulated trading experience), which is perfect for beginners looking to practice their skills without risking real money. Webull’s community investor features, such as forums and social sentiment analysis, help traders stay informed about market trends. Although Webull doesn’t provide fractional shares or sophisticated financial planning tools like some competitors, its focus on active trading attracts a loyal following.

What is Robinhood?

Robinhood revolutionized the trading world by becoming one of the first platforms to offer commission-free investing in stocks, ETFs, options, and cryptocurrencies. Known for its intuitive and streamlined interface, Robinhood made investing accessible to millions of retail investors and is particularly popular among beginners who value simplicity. The platform also allows for fractional share trading, enabling users to invest with as little as $1. However, unlike Moomoo and Webull, Robinhood lacks the advanced research tools and metrics that appeal to professional traders. While ease of use is Robinhood’s cornerstone, its limited features in areas such as market data and in-depth analysis leave more seasoned traders wanting more.

What is the Main Difference Between Moomoo and Webull?

The main difference between Moomoo and Webull is that Moomoo focuses heavily on advanced market research and global market access, while Webull caters more to active traders who enjoy simplified access to U.S.-based securities. Moomoo provides free Level 2 market data, better analytics, and advanced charting tools, making it ideal for investors who rely on technical analysis or are trading globally. On the other hand, Webull shines in its beginner-friendly features like practice paper trading and easy-to-navigate UI, prioritizing accessibility over granular research tools. If you’re looking for in-depth market updates and data for international trading, Moomoo is the better choice, whereas Webull is perfect for domestic-focused active traders who need a sleek and intuitive trading experience.

What is the Main Difference Between Webull and Robinhood?

The main difference between Webull and Robinhood is that Webull is geared toward active traders looking for advanced tools and customizable analytics, while Robinhood stands out for its simplicity and accessibility to beginner investors. Webull caters to users who want real-time technical indicators, extended-hours trading, and a robust charting experience, making it appealing to day traders and more experienced investors. Conversely, Robinhood simplifies investing by offering fractional shares and an easy-to-use mobile app interface, which lowers the barrier to entry for new investors. While Robinhood is more beginner-friendly, its lack of comprehensive market data and tools may turn off those who seek more in-depth trading capabilities, making Webull a better fit for tech-savvy and advanced users.

What is the Main Difference Between Moomoo and Robinhood?

The main difference between Moomoo and Robinhood is that Moomoo provides advanced trading tools, detailed research capabilities, and access to global markets, while Robinhood prioritizes a simplistic design and accessibility tailored to beginner investors. Moomoo is equipped with powerful resources such as advanced technical analysis tools, Level 2 market data, and customizable charting options, making it a strong choice for experienced, data-driven traders. Robinhood, by comparison, focuses on ease of use with features like fractional share trading and a clean interface that eliminates complexity, ideal for first-time investors. While both platforms offer commission-free trading, Moomoo is superior for research-intensive strategies, whereas Robinhood targets straightforward investing with minimal tools.

Features of Moomoo vs Features of Webull vs Features of Robinhood

- Global Market Access (Moomoo): Moomoo stands out as the only platform among the three that enables trading in international markets like Hong Kong; Webull and Robinhood are U.S.-centric.

- Paper Trading (Webull): Webull is the only platform that offers a robust paper trading feature, allowing users to practice without real money—a feature missing in both Moomoo and Robinhood.

- Fractional Shares (Robinhood): Robinhood is the most accessible choice for small investors, with the ability to trade fractional shares as low as $1, which Moomoo and Webull only offer in a limited or non-existent capacity.

- Advanced Charting (Moomoo & Webull): Both Moomoo and Webull provide highly detailed charting tools, but Moomoo edges out with more customization and institutional trading data. Robinhood lacks this sophistication.

- Cryptocurrency Trading (Webull & Robinhood): Webull and Robinhood both allow crypto trading, but Webull offers a wider variety of cryptocurrencies than Robinhood. Moomoo doesn’t offer crypto support at all.

- Free Level 2 Market Data (Moomoo): Unlike Webull, which requires a subscription, and Robinhood, which doesn’t offer it, Moomoo provides Level 2 market data for free, making it indispensable for certain traders.

- Ease of Use (Robinhood): For beginners or those who prefer a streamlined experience, Robinhood’s focus on simplicity makes it far more user-friendly compared to the advanced interfaces of Moomoo and Webull.

- Community Features (Webull): Webull has integrated social and sentiment analysis tools that connect users to a trading community, a feature not yet adopted by either Moomoo or Robinhood.

Key Differences Between Moomoo and Webull

- Market Access: Moomoo offers trading access to international markets, including U.S. and Hong Kong stock exchanges, while Webull focuses primarily on U.S.-based securities.

- Level 2 Market Data: Moomoo provides free Level 2 market data to all its users, while Webull requires a subscription for this advanced data tool.

- Research Tools: Moomoo emphasizes in-depth research and includes features like smart reports and institutional tracking, whereas Webull offers more basic research capabilities focused on technical analysis.

- Learning Features: Webull provides an intuitive paper trading feature, allowing users to practice trading in a simulated environment—something Moomoo lacks.

- Community Features: Webull integrates social/community-based tools such as forums and sentiment analysis, but Moomoo does not include native social trading options.

- Educational Resources: Moomoo provides structured educational tutorials and market news access, while Webull assumes a more self-guided learning approach and includes fewer comprehensive learning tools.

- Charting Tools: While both platforms offer robust charting options, Moomoo’s customization features and detailed metrics appeal to traders who prefer extremely granular analyses.

Key Similarities Between Moomoo and Webull

- Commission-Free Trading: Both platforms offer zero-commission trading for stocks, ETFs, and options, making them cost-effective for active traders.

- Mobile and Desktop Platforms: Both Moomoo and Webull deliver seamless cross-platform experiences through their mobile apps and desktop interfaces.

- Advanced Charting: Traders on both platforms can access a wide range of technical indicators and charting tools to refine their investment strategies.

- Extended Trading Hours: Both Moomoo and Webull support pre-market and after-hours trading, accommodating users who wish to trade beyond regular market hours.

- Real-Time Data Access: Both platforms provide real-time price quotes for free, ensuring users can make decisions based on the latest market movements.

- Options Trading: Both support commission-free options trading, which is a plus for investors looking to diversify their strategies.

- Regulation Compliance: Both platforms are regulated by top-tier financial authorities, ensuring safety and compliance for trading activities.

Key Differences Between Webull and Robinhood

- User Interface Design: Robinhood is designed for simplicity, catering to beginners, while Webull’s more intricate interface is tailored for intermediate and advanced traders.

- Analytics and Tools: Webull offers more technical analysis capabilities, extensive charting tools, and real-time data, while Robinhood provides basic market data with fewer analytics features.

- Fractional Shares: Robinhood allows users to purchase fractional shares with as little as $1, while Webull introduced this feature later and offers fewer related incentives.

- Cryptocurrency Trading: Both platforms support cryptocurrency trading, but Robinhood allows for direct asset ownership, whereas Webull operates through derivative-based crypto investments.

- Paper Trading Feature: Webull stands out with its simulated paper trading, which helps beginners and seasoned traders refine strategies without financial risk—something Robinhood lacks.

- Community Features: Webull includes community forums where users can discuss trades and market conditions, while Robinhood does not provide social features.

- Account Minimums: Robinhood does not require an account minimum to start investing, while Webull also has no requirement but tends to target slightly more seasoned traders.

Key Similarities Between Webull and Robinhood

- Commission-Free Trading: Both Webull and Robinhood offer commission-free trading on stocks, ETFs, and options, making them highly affordable platforms.

- Cryptocurrency Trading: Both platforms allow users to invest in cryptocurrencies like Bitcoin and Ethereum, broadening their investment options.

- Mobile Focus: Both Webull and Robinhood offer sleek, user-friendly mobile apps designed for trading on the go.

- No Minimum Deposit: Neither platform requires an account minimum to get started, ensuring easy accessibility for every investor.

- Instant Deposit Feature: Both platforms allow instant deposits, so users can begin trading without waiting for funds to clear.

- Security Compliance: Both Webull and Robinhood adhere to strict regulatory and cybersecurity protocols, ensuring users’ investments are protected.

- Quick Signup Process: Both brokers offer a fast onboarding process, including seamless account creation and quick connection to funding methods.

Key Differences Between Moomoo and Robinhood

- Market Data Tools: Moomoo offers professional-grade tools like Level 2 market data for free, whereas Robinhood simplifies with basic market data aimed at beginner traders.

- International Markets: Moomoo allows trading in international markets like Hong Kong and China, making it ideal for global investors, whereas Robinhood is focused exclusively on U.S. equities and crypto.

- Educational Content: Moomoo has a rich library of structured educational resources and reports, while Robinhood’s educational tools are minimal and scattered.

- Interface Design: Robinhood opts for a simplified interface for ease of use, while Moomoo’s interface is more feature-packed and tailored for technical analysis.

- Fractional Shares: Robinhood allows trading in fractional shares for as little as $1, making it accessible for small-budget investors, whereas Moomoo does not offer this feature.

- Customer Support: Moomoo provides detailed customer service options, including phone support, while Robinhood’s support is limited to chat and email.

- Advanced Charting Tools: Moomoo delivers customizable and advanced charting options for active traders, while Robinhood keeps its tools basic and beginner-friendly.

Key Similarities Between Moomoo and Robinhood

- Commission-Free Trading: Both platforms offer commission-free trading, which appeals to cost-conscious investors.

- Mobile Accessibility: Both Robinhood and Moomoo have user-friendly mobile apps for on-the-go trading.

- Options Trading Support: Both platforms allow access to options trading with no additional fees, giving users more versatility.

- Real-Time Data: Both Robinhood and Moomoo provide real-time quote data for users to make informed trades.

- No Account Minimums: Neither platform has a minimum deposit requirement, enabling easy entry for beginner investors.

- Streamlined Signup Process: Both Moomoo and Robinhood offer quick and easy signup processes for new users.

- Focus on Beginner Investors: While Moomoo includes advanced tools for serious traders, both platforms accommodate beginner investors with intuitive designs.

Pros of Moomoo Over Webull and Robinhood

- Global Market Access: Moomoo allows users to trade international stocks, including markets in Hong Kong and China, which neither Webull nor Robinhood currently offer.

- Free Level 2 Market Data: Unlike Webull and Robinhood, Moomoo provides free Level 2 market data to all users, offering a more comprehensive look at market depth.

- Advanced Technical Tools: Moomoo comes with more robust charting and analytics tools, making it ideal for active traders and those relying on technical analysis.

- Institutional Tracking: Moomoo enables users to monitor institutional trading activity, offering valuable insights that Webull and Robinhood do not provide.

- Educational Resources: Moomoo features a rich library of tutorials and research reports for traders to familiarize themselves with market strategies, which is lacking in Robinhood and limited in Webull.

- Customizable Alerts and Notes: The platform allows sophisticated notification customization and note-taking features to assist active traders in tracking opportunities effectively.

- 24/7 Customer Support: Moomoo offers robust customer service, including phone support, which is more extensive than Webull’s and Robinhood’s more limited assistance channels.

Cons of Moomoo Compared to Webull and Robinhood

- Lack of Fractional Shares: Unlike Robinhood, which has made fractional share investing highly accessible, Moomoo does not allow users to invest in fractional amounts.

- Steeper Learning Curve: Moomoo’s advanced tools and technical features might feel overwhelming for beginners compared to the straightforward design of Robinhood and Webull.

- No Cryptocurrency Ownership: While Webull and Robinhood allow users to trade cryptocurrencies easily, Moomoo does not currently support cryptocurrency trading.

- Limited Social Features: Webull offers community-based forums and sentiment analysis, while Moomoo lacks native tools to facilitate discussions or social engagement among traders.

- Paper Trading Unavailable: Unlike Webull, which provides a feature-rich paper trading simulator, Moomoo does not include any practice trading functionality for new users.

- Focused on Experienced Traders: Beginners might find Moomoo’s interface more challenging compared to the intuitive and beginner-friendly designs of Robinhood or Webull.

- Subscription Costs for Add-Ons: While Moomoo provides most tools for free, some additional advanced tools may require subscriptions, making it potentially pricier than Webull or Robinhood for casual traders.

Pros of Webull Over Moomoo and Robinhood

- Paper Trading: Webull excels with its simulated paper trading feature, which is perfect for beginners to practice without financial risk—a feature Moomoo and Robinhood lack.

- Community Investing Tools: Webull integrates social forums and sentiment analysis, allowing users to share ideas and gain insights from the trading community.

- Comprehensive Technical Indicators: Webull offers 50+ technical indicators for charting, making it a standout choice for technical analysts compared to Robinhood’s limited options.

- Cryptocurrency Trading: Webull supports cryptocurrency trading for major coins like Bitcoin and Ethereum, giving it a significant edge over Moomoo, which doesn’t offer crypto.

- Advanced Customization: Webull allows users to customize their technical charts more extensively than Robinhood or even Moomoo.

- Extended Trading Hours: Webull provides extended pre-market and after-hours trading, offering a competitive edge for traders who want to act on after-hours news.

- Access to Fractional Shares: While not as beginner-focused as Robinhood, Webull still allows users to trade fractional shares, ensuring cost efficiency for small-scale investments.

Cons of Webull Compared to Moomoo and Robinhood

- Limited Educational Content: While Webull has community forums, it lacks the in-depth educational tutorials and research resources provided by Moomoo.

- No Global Market Access: Unlike Moomoo, which offers international trading, Webull is restricted to U.S.-based stocks and ETFs only.

- Premium for Level 2 Data: While Moomoo provides free Level 2 market data, Webull requires users to pay a subscription fee for access to this feature.

- Complex Interface for Beginners: Compared to Robinhood’s simple and intuitive interface, Webull’s feature-heavy design can be intimidating for novice investors.

- Limited Customer Support: Webull’s customer service is mostly restricted to email and chat, whereas Moomoo provides more robust support options, including phone assistance.

- No Interest on Idle Cash: Unlike Robinhood, which offers interest on uninvested funds through its cash management feature, Webull does not provide any similar benefit.

- Less Focus on Simplicity: While Webull prioritizes active, feature-rich trading, it lacks Robinhood’s seamless and accessible environment that appeals to beginners.

Pros of Robinhood Over Moomoo and Webull

- Fractional Share Trading: Robinhood allows users to invest in fractional shares with as little as $1, making it a more accessible platform for small-scale investors compared to Moomoo, which doesn’t offer this feature.

- Beginner-Friendly Interface: Robinhood’s minimalist and intuitive design makes it easier for first-time investors to start trading compared to the advanced, feature-heavy interfaces of Moomoo and Webull.

- Crypto Ownership: Robinhood enables users to buy and hold cryptocurrencies like Bitcoin directly, providing real ownership, which Moomoo doesn’t offer and Webull implements through derivatives.

- Instant Fund Access: Robinhood grants users immediate access to deposited funds (up to a certain amount), allowing new traders to act on opportunities faster compared to Moomoo and Webull.

- Cash Management Features: Robinhood offers a cash management program that includes interest on uninvested funds and a debit card option—features not available with Moomoo or Webull.

- Ease of Onboarding: Robinhood’s streamlined account creation process and fast approval make it particularly attractive for new investors compared to the slightly more involved process of Webull or Moomoo.

- No Learning Curve: Unlike Moomoo and Webull, which cater to more technical or seasoned traders, Robinhood’s platform eliminates complex tools, ensuring it remains user-centric from the start.

- Push for Financial Inclusion: Robinhood’s no-minimum deposit structure, combined with fractional shares, supports democratized investing more effectively than Webull or Moomoo.

Cons of Robinhood Compared to Moomoo and Webull

- Lack of Advanced Analysis Tools: Unlike Moomoo and Webull, Robinhood doesn’t provide advanced charting tools or technical indicators, making it less suitable for professional or active traders.

- No Level 2 Market Data: Robinhood does not offer Level 2 market data, which is an essential feature available for free on Moomoo and as a subscription with Webull, crucial for in-depth market analysis.

- Limited Educational Resources: Robinhood offers fewer educational tools and tutorials for its users compared to Moomoo, which actively supports investor learning with robust resources.

- Restricted International Access: Robinhood is only available to U.S. users and doesn’t allow access to international markets, unlike Moomoo, which supports global stock trading.

- No Paper Trading: Robinhood lacks a virtual or paper trading feature, which is a major advantage for Webull users who can practice trading strategies without risking real money.

- Limited Crypto Options: Although Robinhood offers cryptocurrency trading, its selection of available cryptocurrencies is more limited compared to Webull’s growing catalog.

- Customer Support Limitations: Robinhood’s customer support is less robust, as it is mainly limited to chat and email, lagging behind Moomoo’s 24/7 phone support.

- Basic Research Capabilities: Robinhood’s research tools are relatively minimal compared to the advanced market insights provided by Moomoo and Webull, making it less appealing for users reliant on data-driven decisions.

Situations When Moomoo Is Better Than Webull and Robinhood

- Trading in Global Markets: If you’re looking to invest beyond U.S. markets and access international stocks, such as Hong Kong or Chinese markets, Moomoo is the superior choice as Webull and Robinhood are limited to U.S.-based securities.

- Advanced Market Insights: Moomoo is the best option for traders who need free Level 2 market data, institutional tracking, and detailed research tools not available on Webull or Robinhood.

- Data-Driven Decision Making: When detailed charting and technical analytics are paramount, Moomoo’s professional-grade technical tools and smart trading analytics give it an edge over the simpler offerings of Robinhood and Webull.

- Sophisticated Learning Resources: If you want structured tutorials, in-depth research reports, and a wide array of educational materials, Moomoo outshines both Robinhood and Webull, which have limited educational tools.

- Comprehensive Customer Support: When quick and reliable customer assistance is critical, Moomoo’s 24/7 customer support, including phone service, offers significant advantages over Robinhood and Webull’s more restricted support.

- Experienced Trader Focus: For an investor who prioritizes professional-grade tools and doesn’t mind a steeper learning curve, Moomoo provides advanced features tailored to seasoned traders.

- Customizable Alerts and Tools: If you need highly customizable notifications and technical features, then Moomoo’s robust functionality makes it highly appealing compared to the more standardized tools available on Webull and Robinhood.

Situations When Webull Is Better Than Moomoo and Robinhood

- Practicing Trading Skills: If you’re a beginner or even an experienced trader looking to test strategies without risking real money, Webull’s paper trading simulator sets it apart from Moomoo and Robinhood.

- Cryptocurrency Enthusiasts: For those wanting to trade a variety of cryptocurrencies, Webull offers a broader selection of crypto trading options than Robinhood and completely outclasses Moomoo, which doesn’t support crypto at all.

- Social Features for Traders: When community engagement and social sentiment tools are valuable, Webull outperforms both Moomoo and Robinhood by allowing users to interact with forums and gauge market trends.

- Extended Trading Hours: Webull provides exceptional trading flexibility with more comprehensive pre-market and after-hours trading than what Robinhood and Moomoo offer.

- Customizable Charting for Technical Traders: If you prefer to adjust and refine chart settings to suit your trading preferences, Webull’s advanced technical indicators and chart customization are far more intricate than Robinhood’s or even Moomoo’s.

- Frequent Small Trades: Active traders who prioritize commission-free options trading and real-time analytics will find Webull’s features more aligned with frequent trading compared to Robinhood’s simplicity or Moomoo’s international focus.

- Balance of Simplicity and Tools: For intermediate traders who want more detailed tools than Robinhood but aren’t ready for the complexity of Moomoo, Webull strikes the perfect balance.

Situations When Robinhood Is Better Than Moomoo and Webull

- First-Time Investors: If you are entirely new to investing and prefer an app with an extremely simple, beginner-friendly interface, Robinhood is easier to navigate than Moomoo or Webull.

- Small Budget Investors: For those on a tight budget, Robinhood’s ability to buy fractional shares for as little as $1 makes it a perfect entry point, a feature neither Moomoo nor Webull matches.

- Instantaneous Trading Access: When you need to start trading immediately, Robinhood’s instant deposit feature allows you to access funds faster compared to the delayed availability in Webull and Moomoo.

- Passive Investors: If you’re a casual investor who doesn’t require advanced tools or global access, Robinhood’s streamlined design with fewer distractions can be a better option.

- Interest on Idle Funds: For users interested in earning returns on uninvested cash, Robinhood’s cash management feature is a unique offering that isn’t available with Moomoo or Webull.

- Crypto Simplicity: For beginners in cryptocurrency, Robinhood’s direct asset ownership and ultra-simple UI make crypto trading easier compared to Webull’s relatively more technical setup and Moomoo’s total lack of support.

- Mobile-Friendly Design: If you prioritize an ultra-intuitive mobile interface, Robinhood’s minimalist app is far easier to use for new investors compared to the feature-packed but more complex experiences offered by Webull and Moomoo.

Choosing the Right Platform Depends on Your Financial Goals

Finding a trading platform that suits your needs involves evaluating what your priorities are in terms of strategy, tools, and market access. Platforms like Moomoo, Webull, and Robinhood bring varied benefits to different types of traders.

Ease of Use Matters for Different Experience Levels

Moomoo’s feature-heavy platform may be challenging for beginners, but experienced investors often appreciate its detailed market data and international trading access. For those who are still new to stock trading, Robinhood’s simple interface offers an easier starting point. It’s intuitive and free from the distractions that advanced tools sometimes present. In comparison, Webull balances user accessibility and functionality, providing tools that cater to intermediate to advanced traders.

Robinhood takes the lead when it comes to simplifying the investor’s entry point. Small-budget investors can get started with fractional shares, breaking down the barriers to investing. On the other hand, paper trading on Webull provides novices with a chance to test strategies without monetary risks before entering live markets.

Research Tools and Data Accessibility

For traders who make decisions based on analytics, the platforms have varying levels of tools available. Moomoo provides comprehensive tools like free Level 2 market data and institutional tracking. These are particularly helpful for those looking at professional or technical trading strategies. Webull also delivers in terms of analytics, but some features like Level 2 data are behind a paywall. Meanwhile, Robinhood offers a simpler approach and lacks those in-depth research tools.

For investors keen on crypto trading, Webull and Robinhood are viable choices. Webull differentiates itself by offering a broader selection of cryptocurrencies compared to Robinhood. On the other hand, Moomoo misses out on cryptocurrency capabilities altogether. Investors will have to weigh whether crypto-related features are essential to them when picking one platform over the others.

Features That Cater to Diverse Investors

Each platform brings a specific set of features designed for a particular audience. Moomoo caters to those who need global market access and investors who prefer advanced tools for data-driven decisions. Webull works well for those who want a mix of analytics and social tools, while Robinhood keeps it extremely straightforward for those who prefer simplicity in their investments.

Market Conditions Can Influence Platform Performance

External factors such as market volatility may highlight the strengths and weaknesses of each platform. Assessing how each performs under these circumstances is key.

Handling Volatility and Speed of Execution

When market activity spikes, execution speed becomes critical for traders. Moomoo’s access to advanced data and tools allows experienced users to respond quickly to changing market conditions. For intermediate traders, Webull provides sufficient real-time data and analytics to stay ahead. Robinhood, although simple, is not built for high-frequency trading, making it less effective in volatile situations.

It’s worth pointing out that platform reliability during market surges can also vary. Availability of customer support can provide further reassurance. Moomoo’s 24/7 assistance through phone support could prove useful during such times, whereas Webull and Robinhood rely on less immediate communication methods.

Importance of Account Diversification

Apart from platform features, market conditions can sometimes support having accounts across multiple services. Balancing ease of use from Robinhood, analytics from Webull, and international opportunities from Moomoo can offer investors diversified benefits. This approach might require more maintenance but could give traders access to broader market coverage and tools.

Costs Beyond Commissions

While all three platforms offer commission-free trading, other costs can arise. Moomoo provides free Level 2 data, which represents a saving for traders who rely on it regularly. In contrast, Webull charges for certain premium features, which should be factored into your budget. Additionally, Robinhood’s simple layout means you spend less on additional tools but may miss out on critical insights. Deciding how costs impact your overall strategy is an essential factor for investors.

Comparing Strategies Across Different User Needs

Finding the right trading platform isn’t just about tools. Strategy also plays a significant role in which platform fits best.

Active vs. Passive Investing

People leaning toward active trading will find Moomoo and Webull the better options. Active investors need advanced charting, technical analytics, and extended market hours—all of which are supported by both these platforms. Moomoo appeals more to professionals, while Webull accommodates both frequent traders and those exploring trading as a hobby.

Robinhood leans more toward passive investors. It’s easy to manage, with no overwhelming features to sift through. Simple tools make it comfortable for long-term investors who prefer a buy-and-hold strategy. Fractional shares further support smaller investments for those building long-term portfolios gradually.

Integrating Crypto and Beyond

For crypto enthusiasts, the choice narrows down to Webull and Robinhood based on their support for cryptocurrency trading. Webull provides more diversity with its offerings. While Robinhood links cryptocurrencies to its simplified interface, beginners often prefer it for first-time investments. Moomoo skips the crypto segment entirely, making it less relevant for those diversifying into digital currencies.

When determining which trading platform aligns with your strategy, consider the purpose behind your investments. Whether aiming for quick trades, market insights, or stable, easy-to-manage portfolios, matching features to goals simplifies platform selection.

FAQs

Can I use multiple trading platforms like Moomoo, Webull, and Robinhood simultaneously?

Yes, you can use multiple platforms at the same time. Many investors use different platforms to benefit from their unique features. For example, you could use Moomoo for trading international stocks, Webull for paper trading and advanced charting, and Robinhood for ease of use and fractional shares. However, managing multiple accounts may require extra effort to track your portfolio and transactions across platforms.

Do any of the platforms charge hidden fees despite offering commission-free trading?

While Moomoo, Webull, and Robinhood offer commission-free trading, additional fees may apply in specific scenarios. For instance, regulatory fees from FINRA or SEC may be passed on to users, and Webull charges for access to advanced features like Level 2 market data. It’s important to read each platform’s fee disclosures carefully to fully understand potential costs.

Are these trading platforms suitable for day trading?

Yes, each of these platforms is suitable for day trading, but Moomoo and Webull are better equipped due to their advanced technical tools, charting options, and access to extended-market hours. Robinhood is more limited for day traders as it lacks advanced tools like Level 2 market data and in-depth charting capabilities. Additionally, be mindful of the pattern day trading rules that apply to accounts with less than $25,000 on any of these platforms.

What security measures are in place to protect user funds and data?

Moomoo, Webull, and Robinhood are all regulated by top-tier financial authorities like FINRA and the SEC, and they offer SIPC protection for funds and securities, up to $500,000. All platforms employ advanced encryption to protect user information and operate under strict privacy policies. Two-factor authentication (2FA) is also standard for added security across all three platforms.

Can I set up automated trading strategies on these platforms?

No, none of these platforms currently support fully automated trading strategies. While Webull and Moomoo provide advanced analytics and alert tools for manual decision-making, they don’t allow algorithmic or robo-trading. Robinhood also lacks support for automated trading. If automating strategies is a priority, you may need a different brokerage or third-party tools integrated with APIs.

Are there options for joint or custodial accounts available?

Robinhood does not currently offer joint or custodial accounts, limiting account types to individual taxable accounts. Webull also does not provide joint accounts but offers custodial accounts for minors. Moomoo currently supports only individual accounts and does not have joint or custodial account options either. For these account types, other brokerages may be more suitable.

Which platform is better for long-term investment strategies?

Robinhood is often considered better for long-term investors, particularly beginners, due to its simplicity, fractional shares, and cash management options. Long-term investors who need advanced research and deeper market insights, however, may find Moomoo a more fitting choice. Webull falls somewhere in the middle, offering tools for both active traders and long-term investors but doesn’t provide features like fractional shares that might be more attractive for long-term budgeting.

Can I use these platforms outside the United States?

Webull and Robinhood are limited to U.S. users, whereas Moomoo operates in international markets like Hong Kong and China and may be accessible in other regions. However, you’ll need to confirm local regulations and whether these platforms accept investors from your specific country. Keep in mind that external geographic usage may be restricted based on the platform’s policies and local compliance requirements.

Are dividends automatically reinvested into my portfolio?

Neither Moomoo nor Webull offers automatic dividend reinvestment plans (DRIP). You’ll need to manually reinvest your dividends into stocks or ETFs of your choosing. Robinhood, however, allows users to set up automatic reinvestment for dividends. If passive reinvestment is an important part of your strategy, Robinhood would be the best choice among the three platforms.

Moomoo vs Webull vs Robinhood Summary

Choosing between Moomoo, Webull, and Robinhood ultimately depends on your trading goals, level of experience, and the features you value most. Moomoo caters to traders seeking an international market focus and advanced research tools. Webull strikes a great balance for both intermediate and tech-savvy investors who want paper trading or advanced technical indicators. On the other hand, Robinhood is the simplest and most accessible option, ideal for beginners and those prioritizing ease of use, fractional shares, and cash management. By understanding these platforms’ differences, similarities, pros, and cons, you can make a well-informed choice that aligns with your financial objectives.

Comparison Table: Moomoo vs Webull vs Robinhood

| Aspect | Moomoo | Webull | Robinhood |

|---|---|---|---|

| Differences | Offers global market access (U.S., Hong Kong, China) and free Level 2 market data. | Includes paper trading and extensive chart customizations but limited to U.S. securities. | Beginner-friendly interface with fractional shares and cash management but lacks advanced tools. |

| Focuses on seasoned and data-driven traders. | Balances simplicity and tools for intermediate and advanced traders. | Ideal for first-time investors with small budgets. | |

| No cryptocurrency support. | Provides more crypto options compared to Robinhood. | Supports direct crypto ownership. | |

| Similarities | Commission-free trading for stocks, ETFs, and options. | Commission-free trading for stocks, ETFs, and options. | Commission-free trading for stocks, ETFs, and options. |

| Real-time price quotes and advanced charting tools. | Real-time price quotes and advanced charting tools. | Real-time price quotes for basic trading. | |

| Seamless interfaces for both mobile and desktop users. | Seamless interfaces for both mobile and desktop users. | Extremely simple and mobile-focused design. | |

| Features | Free Level 2 market data and institutional tracking for detailed market analysis. | Offers social tools like forums and sentiment analysis along with paper trading. | Fractional share trading with investments as low as $1 and cash management features. |

| 24/7 customer support with advanced educational resources. | Advanced technical indicators for charting but requires subscriptions for Level 2 market data. | Beginner-friendly app with instant fund access and direct crypto purchases. | |

| No fractional shares or crypto trading. | Supports partial crypto investments but lacks global market access. | Simplifies trading but lacks advanced charting and market depth tools. | |

| Pros | Advanced tools and institutional tracking. | Robust paper trading simulator and pre-market/after-hours trading. | Most user-friendly for beginners and ideal for small-budget investors. |

| Highly detailed customization for technical analysis. | Broad range of technical indicators and community forums. | Fractional shares and interest earned on idle cash. | |

| 24/7 customer support surpasses competitors. | Perfect blend of tools for intermediate users with no learning curve. | Fastest account setup and instant deposit feature. | |

| Cons | Complex for beginners and lacks fractional shares and crypto offerings. | No global market access and requires subscriptions for some tools. | Lacks advanced research tools, Level 2 data, and paper trading functionality. |

| Less accessible for casual or passive investors. | More complicated UI for absolute beginners. | Limited customer support and available crypto options. | |

| Situations When It’s Better | Best for experienced and global traders seeking detailed analytics and research. | Ideal for learning, thanks to paper trading and advanced customizations. | Perfect for first-time investors or those prioritizing simplicity and fractional shares. |

| Advanced traders needing free Level 2 data and institutional tracking. | Great for active trading and community engagement. | Suitable for crypto beginners with a user-friendly interface. |